In 1955, Remington Rand merged with the Sperry Corporation, a leading producer of electronic weaponry, hydraulic equipment, and farm machinery. James Rand was sixty-nine years old in 1955 and contemplating retirement. His company, which had grown an unimpressive 75 percent between 1930 and 1946, needed a senior partner, and Sperry seemed like a good choice. Run by Harry Vickers, a self-taught hydraulic engineer and a friend of Rand’s, Sperry was a healthy, prosperous, well-managed firm whose revenues had zoomed nearly 700 percent since 1946. Sperry was almost twice as big as Remington Rand, and much more vigorous. (In 1954, Sperry grossed $57 million on $441 million in revenue. Remington Rand, on the other hand, earned $27 million on $224 million in sales.) But military contracts accounted for most of Sperry’s revenues, and the firm wanted to establish a broader, more stable base in the private sector, preferably in electronics.

Shortly before the merger, Remington Rand’s UNIVAC had an installed base of about thirty big computers to IBM’s four. Meanwhile, UNIVAC’s makers were happily scrambling to fill a substantial backlog of orders. On the basis of these facts, Vickers believed that he had acquired the country’s leading computer manufacturer. But he was in for a shock. In 1954 IBM started taking orders for the 700 series of computers, then on the drawing boards and much superior to UNIVAC’s machines, and UNIVAC soon slipped to second place. By 1956, IBM had seventy-six large computers in the field to UNIVAC’s forty-six, and its backlog was almost three times the size of UNIVAC’s. In medium-sized computers, the fastest-growing segment of the computer market, IBM seemed to be running the race alone. The company had placed seven times as many of these computers (369) as all the other manufacturers combined, and had four times as many (920) on order. Caught unprepared, UNIVAC didn’t even have a medium-sized machine on the market until 1958.

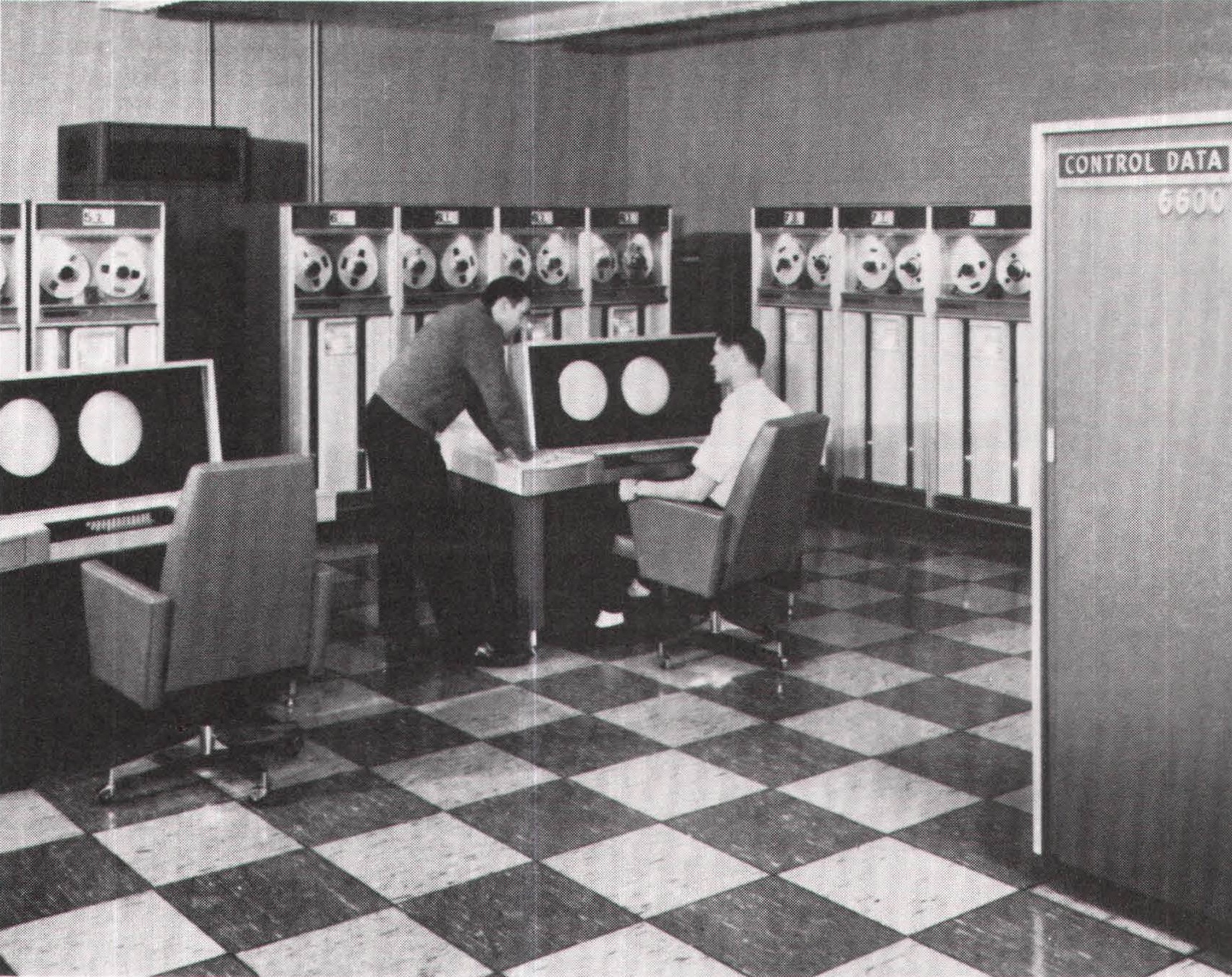

What went wrong with UNIVAC? Just about everything. More of a promoter and manipulator than a manager or builder, James Rand ran a one-man show. Although his decision to get into computers was quite astute, he really regarded the UNIVAC division as a sideline; he was more interested in electric shavers, office furniture, and typewriters. UNIVAC wasn’t set up right, either. It was divided into two parts, with Eckert and Mauchly’s enterprise in Philadelphia, and the other arm, Engineering Research Associates (ERA), in St. Paul, Minnesota – and the two halves didn’t get along with each other. In 1957, after organizational changes that put St. Paul at a disadvantage, William C. Norris, one of ERA’s founders, left to form his own company, taking most of the staff with him. With masterly command of technology, Norris’s venture, the Control Data Corporation, became the leading manufacturer of supercomputers – big, high-speed machines capable of performing tens of millions of operations a second.

Meanwhile, Remington Rand’s sales force proved no match for IBM’s. When a team of IBM salesmen called on a customer, they worked hard to show how the installation of an IBM computer would get the payroll out faster, keep better track of sales, boost efficiency, and save money. And they had a corps of specialists – programmers, engineers, and business experts – to assist them. When a group of UNIVAC salesmen visited a client, however, they tended to harp on technological matters – mercury delay lines, decimal versus binary computation – that went right over the heads of their customers, who were chiefly interested in the answer to one question: “What will a computer do for me?” Although UNIVAC had a team of traveling salesmen that whipped up interest in computers, Remington Rand’s branch offices failed to follow through. They were more familiar with the company’s traditional products, which were much easier to sell.

And if all this wasn’t bad enough, UNIVAC’s managers were as inept at negotiating profitable deals as Eckert and Mauchly. In 1956, in mindless repetition of Eckert and Mauchly’s penchant for fixed-fee contracts, UNIVAC signed a $3 million agreement with the Atomic Energy Commission for the development and construction of a supercomputer. The Livermore Atomic Research Computer (LARC) ended up costing $20 million, and UNIVAC had to make up the difference. Although UNIVAC managed to sell a second LARC to the Navy, they didn’t recoup their loss.

As long as Rand, who became Sperry’s vice chairman after the merger, was in charge of UNIVAC, it was difficult to attack the division’s problems. When Rand finally retired in 1959, Vickers brought in Dause L. Bibby, a former IBM vice president, to run UNIVAC. But it was too late. “At IBM,” recalled a former Sperry executive, “Bibby would press a button and a thousand guys in pin-striped suits would come out and salute; when he pressed the button at UNIVAC, nothing happened. Mobilizing an effective organization takes one kind of talent; breathing life into a dead one takes another.” UNIVAC lost about $250 million between 1956 and 1967, when it finally turned a minuscule profit.

IBM’s lead was unassailable. By 1961, when vacuum-tube computers were giving way to a new generation of machines consisting of transistors (which we’ll discuss in the next chapter), 71 percent of the country’s $1.8 billion in computers had been built by IBM. UNIVAC was a distant second, with about 10 percent of the market, followed by Burroughs and then, more or less in a clump, Honeywell, RCA, Philco, NCR, General Electric, and Control Data. A host of smaller companies, such as Bendix and Royal McBee, fluttered at the bottom of the industry, supplying small computers. And by 1964, when transistor machines were giving way to a third generation of computers composed of integrated circuits, IBM’s share of the $5.3 billion in installed computers had climbed to 76 percent. IBM had risen to the top by dint of its vision, excellence, and dedication, and the ineptitude of its competitors.