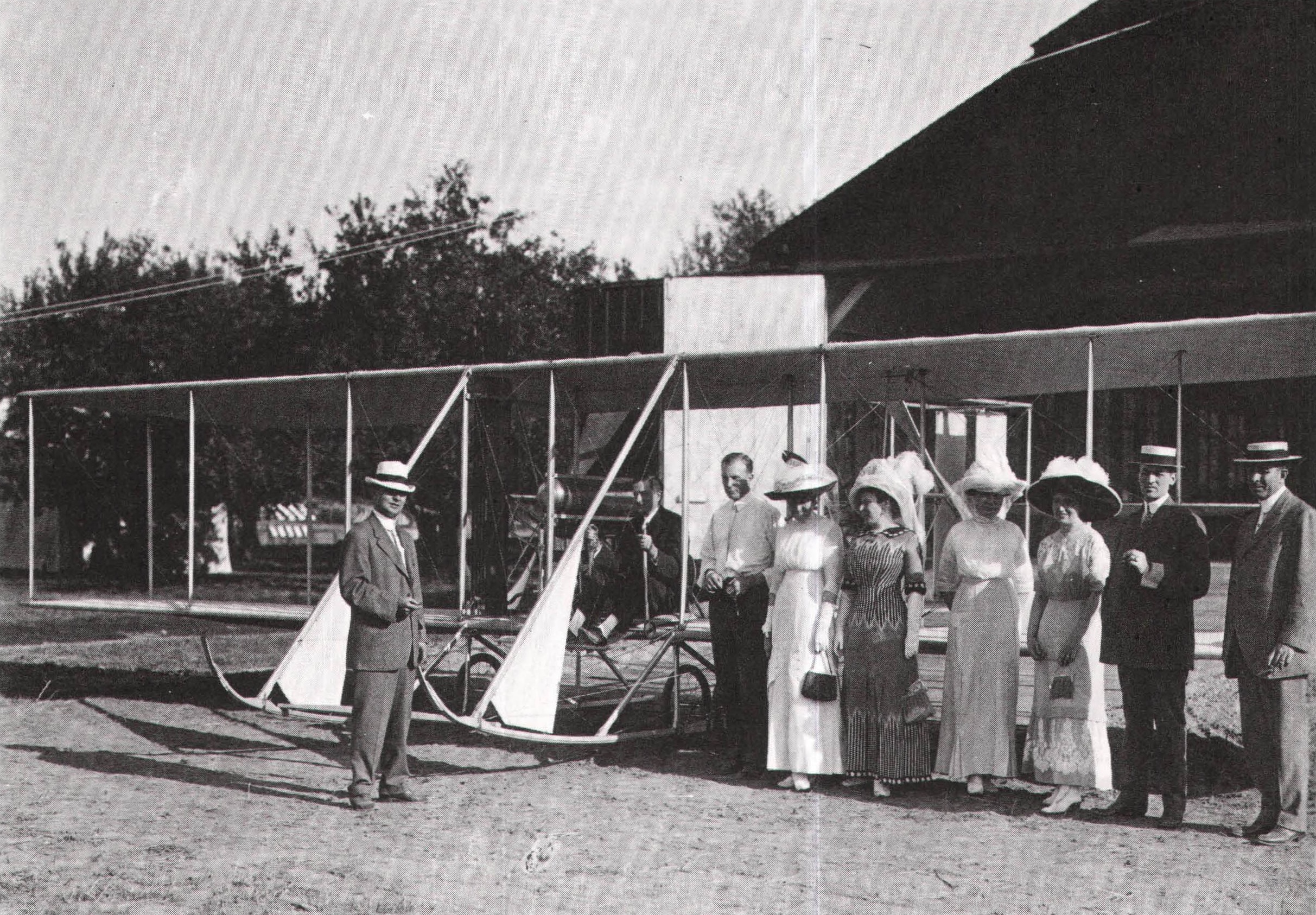

The Computing-Tabulating-Recording Corporation (CTR), an amalgam of four firms, was organized in 1911 by Charles Ranlett Flint, a financier who specialized in the formation of industrial consolidations. Flint was a colorful figure, an international wheeler-dealer who earned his first million selling munitions in Latin America and who was popularly known, in the catchy if exaggerated phrase of a Chicago reporter, as “the father of trusts.” Flint had a hand in the creation of more than two dozen companies. His largest and most famous merger was the United States Rubber Company, organized in 1892; and in one particularly energetic year, from 1898 to 1899, he established American Chicle, American Woolen, United States Bobbin & Shuttle, and five other firms. An indefatigable man with thick muttonchop whiskers, Flint was also an avid sportsman – a hunter, a flier, a founder of the Automobile Club of America, and the owner of one of the world’s fastest yachts.

In most of Flint’s mergers, a group of firms in the same industry were assembled under a single corporate umbrella, which endowed them with numerous economies of scale. But CTR was different; it was an uneasy assortment of vaguely related enterprises, much like a modern conglomerate. In addition to Hollerith’s Tabulating Machine Company, based in Washington, D.C., it included the International Time Recording Company, a manufacturer of employee time clocks and other time-keeping instruments, with plants in Binghamton an d Endicott, New York; Bundy Manufacturing, a much smaller time clock maker in Poughkeepsie, New York; and the Computing Scale Company of America, a Dayton, Ohio, producer of retail scales and cheese and meat slicers. Altogether, CTR had 1,200 employees and a capital value of $17.5 million.

In some ways, CTR was stronger than the sum of its parts. For instance, it enjoyed greater financial resources and borrowing power than any of its subsidiaries. At least in theory, therefore, CTR was in a better position to weather hard times, since a superior performance by one division might offset a bad showing by another. Nevertheless, the merger really didn’t make much administrative or marketing sense. With distinctly different products and widely dispersed factories, CTR was a company in search of a direction. International Time, the largest division, dominated its market and was doing quite well; Tabulating Machine, the second largest, also dominated its market but was short on cash for expansion and new products and was facing competition for the first time. Meanwhile, Computing Scale, the third largest part of CTR, was getting along fairly well but the scale and slicer business didn’t have a very bright future. (As for little Bundy, it was folded into International Time.)

However, Flint and his associates were considerably less interested in forging a well-integrated company than in reaping large capital gains. Although they had paid $10.5 million for the four parts of CTR, Flint and his underwriters inflated the value of the new company’s stock by putting a premium on various dubious intangibles – the reputations of the firms, their positions in the market, the strength of their management, and so on. Almost overnight, the total value of CTR’s stock was jacked up to $ 16.5 million, giving Flint and his investors a quick and clever profit of $6 million. (Another $1 million in hard assets accounted for CTR’s $17.5 million capitalization.) It was all quite sneaky, but hardly illegal.

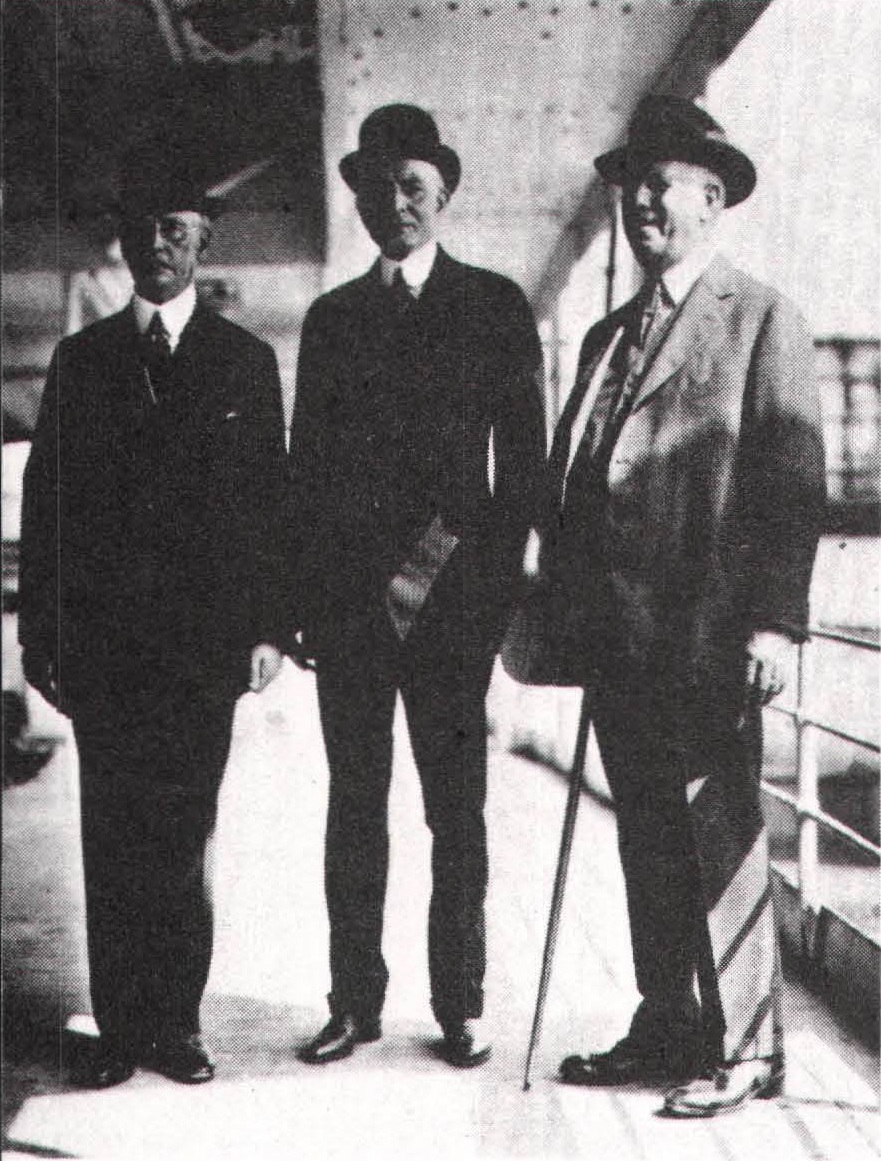

During its first decade, from 1911 to 1921, CTR was dominated by International Time. International Time’s president, George Fairchild, was appointed CTR’s chairman, and his chief operating officer, Frank Kondolf, became CTR’s president. A congressman and newspaper publisher, Fairchild was really a figurehead for the company, and his outside interests kept him away from the firm for weeks on end. Kondolf was in charge of CTR’s day-to-day affairs, but he wasn’t forceful or cunning enough for Flint’s taste, and the financier started looking for a replacement. Watson heard about the opening and, after meeting Flint and the CTR board, was offered the job. In May 1914, Watson stepped in as general manager, with the understanding that he would be elevated to the presidency after the favorable settlement of the NCR suit.